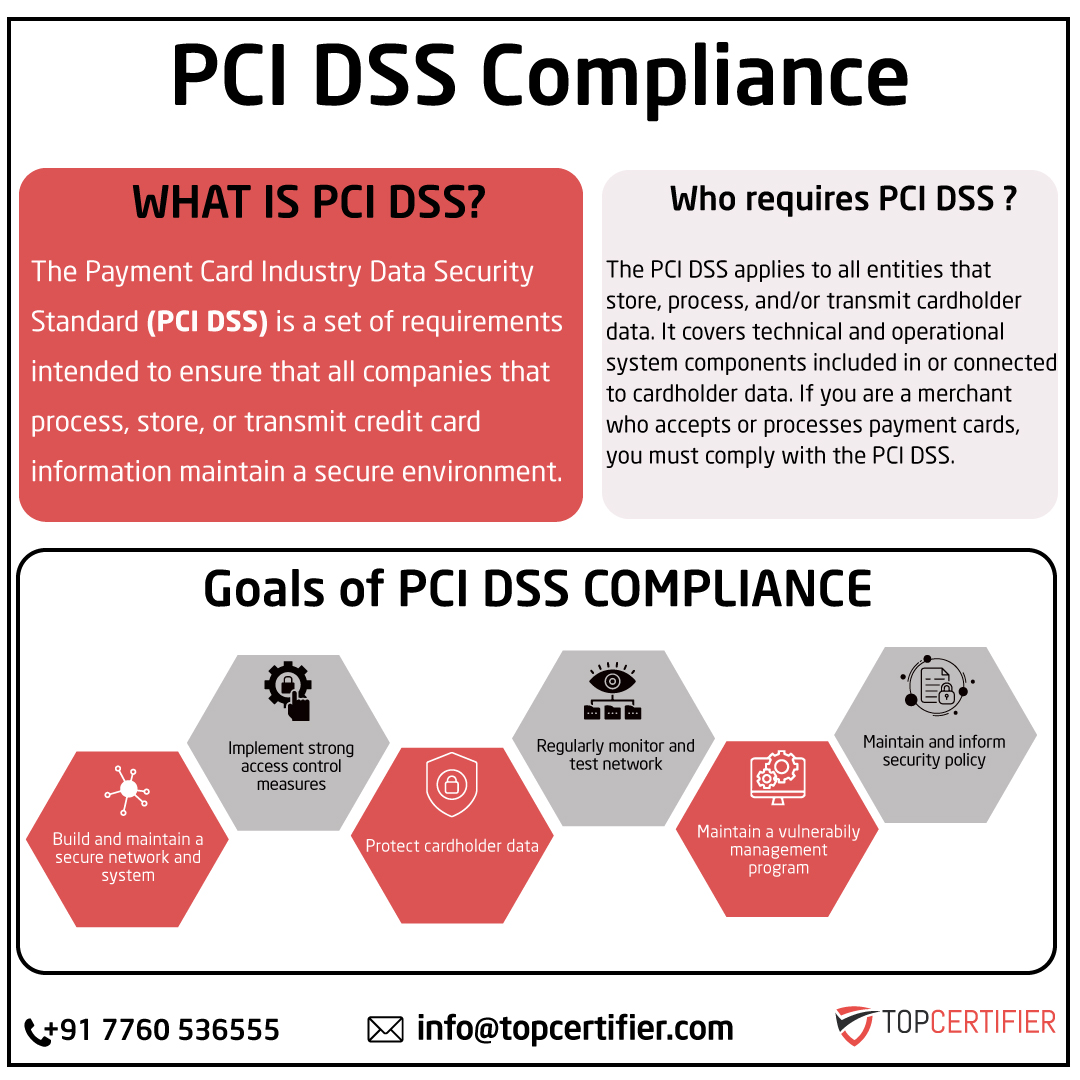

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards that are designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment. The standard is developed and maintained by the Payment Card Industry Security Standards Council (PCI SSC). It is required for any organization that processes credit card transactions, regardless of the size or number of transactions.

PCI DSS Certification in Washington is of utmost importance, it helps organizations to protect sensitive customer data, such as credit card numbers and other personal information. The standard includes a set of security controls and best practices that organizations must implement in order to protect this data. This is critical, as a data breach can have significant financial and reputational consequences for an organization.

PCI DSS certification also helps organizations maintain the trust of their customers. It demonstrates an organization's commitment to protecting sensitive customer data and gives customers and other stakeholders peace of mind that the organization is taking the necessary steps to protect its data.

Additionally, PCI DSS compliance requires organizations to conduct regular security assessments and penetration tests to identify and mitigate vulnerabilities in their systems and processes. This helps organizations to maintain a robust security posture and identify and address any potential security risks before they can be exploited.